Malaysia's stock exchange looks cheap based on historical earnings, lets look further.

You can't buy it with Interactive Brokers, I trade KLSE stocks with a Singapore broker.

TLDR: Everything depends on KLSE trading volume, which is unpredictable, I think this stock is too expensive now.

Business and Revenue Breakdown

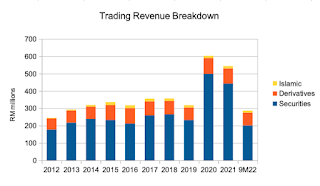

Most of their revenue is from trading:

And most of the trading revenue is from Securities trading:

Financials

Good financials. All stock exchanges seem to follow the same pattern. As of Sep 2022:

- Large net cash position (plus some Investment Securities), no debt

- CFO is basically PBT plus small depreciation and small working capital.

- 40% profit margin (after all expenses, including tax) in 9M 2022.

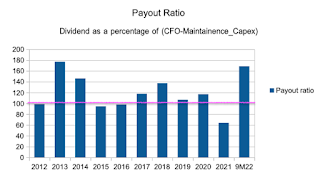

- Minimal Capex with high dividends:

- The dividends are too high:

- They are paying part of the dividend out of accumulated "cash and investment securities". As of 3Q22, "cash and investment securities" is worth RM 565m, or roughly 9% of their market cap (@ 6.40 per share).

Conclusion

This stock exchange is a cash generating machine. The only question is how much you'd pay for it.

If I had to catch a falling knife, I'd probably be willing to pay 12-15X normal earnings. Based on 2017 to 2019 earnings, the price would need to drop significantly, to around RM 3.70 to 4.00. Not buying it now.

4 comments:

Can you recommend some broker please?

Since you're in Europe, can try Saxo to trade KLSE stocks. I haven't tried them.

But I'm a little wary of a brokerage thats part of an investment bank, so I wouldn't put all my money with them.

I would have liked some local broker, possibly also active in Thailand and Vietnam

Theres a good article here: https://www.asiancenturystocks.com/p/the-best-asian-retail-broker

I use UOB Kay Hian. I think all 3 SG banks are the same.

Post a Comment