My last piece on Tin. There's 3 listed tin producers. The third one produces in the DRC which is un-investible. This one is in Australia, which is safer.

Business

A 50% JV in the Renison Tin mine, a hundred year old mine in Tasmania which is still producing. Mine life is projected until 2030, with scope for further extension.

They also own 50% of Rentails: tailings dams from historical mining operations containing around 100,000 tonnes of tin. Significant capex is required to bring this into production. A new DFS should be completed this year to make a decision in 2023.

They used to own copper and nickel interests but these lost lots of money. They sold them off and are now purely focused on tin.

Balance Sheet

All numbers are from their June 2022 Annual Report.

They has a windfall from FY2022's high tin prices. They used it to pay down their debt, and now have 110m in net cash. Held as AUD.

Quick side note: They have 28m of convertible notes receivables. After selling their Copper/Nickel operations, they lent money to develop them, and should be paid back in (MetalX's choice of) cash or shares in March 2025. New mining operations are dodgy, especially in a recession, so let's wait to see if they get paid back.

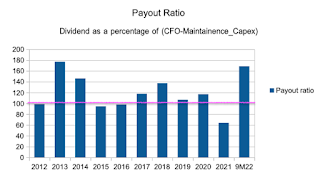

Despite the 2022 windfall, they have not paid dividends. I think they need the money for capex.

Capex

Sustaining capex is 8-10m per year (p10).

In addition, to continue production at Renison until 2030 (Area 5), they need 50-55m capex (p5).

Both the above can be covered by their 2022 windfall.

In 2023 they should make a decision on rentails. An old 2017 estimate is 205m (or around half of this for MLX's share - p14). Lets say 100m in 2017 dollars, which might be 150-200m today. Can be funded from their cashflows if we get another tin spike in the coming years, but don't expect MetalsX to pay dividends anytime soon.

Earning, Cashflows and Breakeven

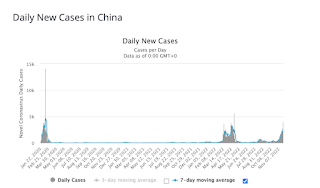

Our starting point is always the tin price:

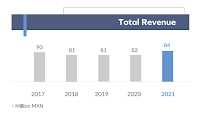

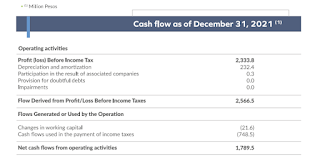

Its hard to look at their long term profitability because past tin results are overshadowed by their money losing copper/nickel operations. Their 2021 AR was the first time they stripped these out. My breakdown of their profits from 2020 onwards, important lines in blue:

As expected, the biggest factor affecting profits is revenue (ASP). This company is highly cyclical.

I estimate their cash breakeven tin price at around AUD 17-22k/ton. At that price their Cashflows from Ops would be zero. If we also cover sustaining capex of 10m per year, we get a required tin price of AUD 19-25K (or 11.8 to 15.5K USD today). The company estimated their AISC at AUD 17K/ton (p3), which I guess is too low. Estimates in AUD are tricky because the AUD is so volatile.

Don't think they've been hedging the tin price, there was no mention of commodities derivatives.

Reserves

Excluding Rentails:

Misc

Information is quite skimpy. I could not find any quarterly results on their website or ASX. Nor any transcripts of shareholder meetings.

Yunnan Tin is the logical acquirer of this company (their 50% partner in the JV). Unlikely to happen now since everyone hates the CCP.

Don't buy right now: