Still think we're in a market correction heading into a recession.

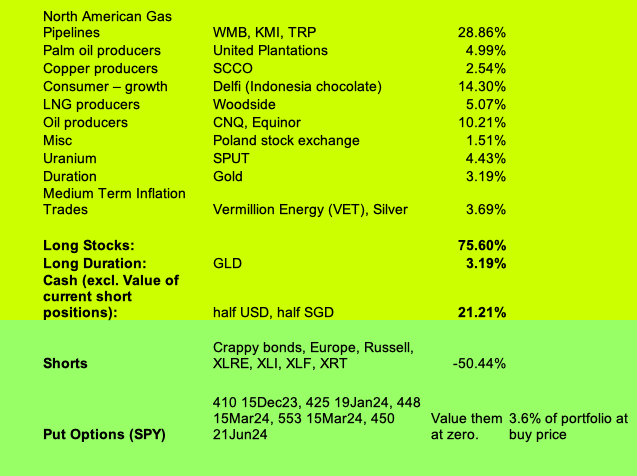

Trades:

- SPY put options are now mostly in the green, but still have a lot of upside - still holding 'em.

- Decrease my VET holdings a bit when WTI was overbought and VIX rises into the high teens. Energy equities can get pounded by the wider market even if energy keeps rising. I'll keep my lower-beta, cash generating, "blue chip" stocks (Woodside, Equinor, CNQ). WHC's price action has been strong, so I haven't trimmed it.

- Use the last-2-day rally for the month-end-markup to add more shorts: Regional Banks (KRE), Poland (EPOL), Airlines (JETS) and Tech (XLK)

Investments:

- Uranium's (SPUT's) price rise has increased it to 5% of my portfolio.

- Longer term, its time to start writing a shopping list. I think it'll be a shallow recession like 2001, not a crisis like 2008. 2024 is an election year, expect the government to drop rates and pump like crazy once the recession starts.

- But there's no rush to buy. I can get 4.8% on USD in Interactive brokers and 5.2% in Tbills. "There is an alternative".