Theres a big hole in my dividend portfolio from selling my REITs. I'm looking at several small listed stock exchanges: most of them have low debt, churn out cashflows/dividends, and their costs are not affected by inflation. They are cyclical, so the current downturn might be a chance to buy.

Business and Revenue breakdown

Despite its name, the Mexican stock exchange only accounts for a small amount of BMV's revenue. I breakdown their 2021 revenue below to get an overview of their business.

SIF ICAP

16% of revenue. SIF ICAP is an inter-dealer broker handling transactions between financial institutions. They deal in govt/corporate bonds, and OTC derivatives (customised contracts that aren't traded on an exchange) such as interest rate swaps and forwards.

2/3rds of SIF ICAP revenue is from Chile, the remainder from Mexico.

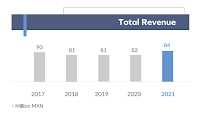

Historical revenue:

Information Services

16% of revenue. 70% of that is from BMV market data, 30% from VALMER (Operations Valuation and market Reference, eg: used to value bonds).

Market Data historical revenue:

Valmer historical revenue:

Equities trading and clearing

13% of revenue. From stocks traded on the BMV. This includes foreign listings on the BMV. eg: Apple or an S&P500 ETF, listed in Pesos.

BMV has a problem with their stock exchange. Only 144 companies are listed, very few for the 15th largest economy in the world. 3 companies delisted this year, at least one of those wanted to re-list in the US. One company listed this year. The usual complaints are about low liquidity.

In 2018, a competing privately-owned stock exchange BIVA, was setup with lower listing requirements aimed at medium sized companies. At its debut it had 52 listings, now it has 88 listings (not sure if they are all equities, or some bonds).

Listing and Maintenance fees

13% of revenue. In 2021, almost all of it were Maintenance fees. This is recurring, unless companies delist.

Only 1/3rd of the maintenance is from shares. While half of it is from corporate or govt bonds:

Derivatives Trading and clearing

Central Depository

33% of revenue.

A Central Depository allows every trade to be recorded, so ownership is recorded by them instead of your stockbroker. After you make a trade, the confirmation is sent to you independently by them. This makes if hard for your broker to commit fraud, and theres no risk of loss if your broker goes bankrupt. This process is slower and more expensive than just relying on your broker (like Interactive Brokers) to hold your stocks. I do not know what percentage of individual trades go through the central depository, and what percentage go through a broker.

The Central depository records holdings from the above segments:

- SIF ICAP (probably only Mexican, doubt it does Chile)

- BMV. Probably BIVA too (?)

- and Derivatives.

Financials

The financials seem almost too good to be true!

- Operating margins (after all expenses, including taxes) are exceedingly high:

- As of 3Q22, cash on balance sheet is greater than all liabilities (not just debt).

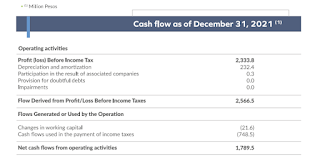

- Cashflows follow profits closely. Depreciation and working capital are minimal:

- Minimal Capex:

Valuation

Conclusion

- Excellent financials and profit margins.

- Mexico has long term growth potential with as NAFTA's low cost manufacturing hub.

- Stock exchanges are a good hedge against inflation.

- The Mexican stock market has structural problems (low liquidity, leading to lack of investor interest, leading to lack of listings). Note the downward trend in Maintenance fees from 2019 to 2021. From a Mexican's point of view: if I lived next to the largest economy and stock market in the world, I'd probably want to list and trade there too.

- Competition from BIVA. I estimate that long term this might affect 25% of revenue ("Equities trading and clearing", plus some "Central Depository" revenue).

- I don't know about competition or cyclicality in the SIF ICAP segment.

- Not yet cheap, but reasonably priced.

1 comment:

Thanks for the detailed analysis. Stock exchanges definitely have one of the best business models available in the world! Personally, I focus on stock exchanges in developed markets as they tend to be more stable. I hold Intercontinental Exchange (the owner of NYSE) which is now just trading at below 20x PE. If you are interested, TMX Group (the operator of Canadian stock exchange) is quite attractive at current price at around 19x PE.

Post a Comment