AIT released disappointing 2021 results, and the stock price dived 9%. A quick update.

Drop in Income

AIT's 2021 "Income available for distribution" was down 11%, or SGD 12.6m.

The culprit was Income tax expenses, up SGD 50m, "mainly due to higher deferred tax liabilities arising from acquisition of aVance 6 and annual revaluation; together with lower current income tax resulting from reversal of dividend distribution tax (“DDT”) provision in FY 2020." In English, 2020's income was artificially inflated by the reversal of a dividend distribution tax provision; now 2021's income is back to normal. But I don't know how much of the 50m this contributes to, and how much of the remainder is a one-off.

Other than that, their numbers look OK. 98% of rent was collected, though only 11% of the properties were populated. Rental reversions were 5.5%.

Risks

Longer term, the risks I see are:

Cyclical Property Downturn

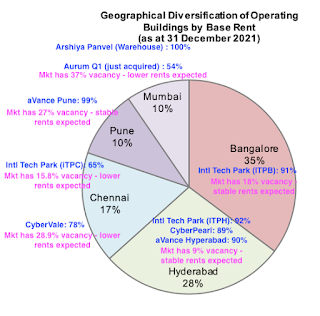

Here are their properties/areas. The blue numbers are occupancy rates. The pink text gives the vacancy rates in each property's micro-market:

Source: 2021 Results, pages 5, 32-33.

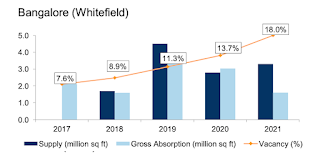

1/3rd of their rent is from ITPB. This micromarket is under some pressure due to un-absorbed supply added in 2021:

Source: 2021 Presentation Sides, p18

Their Chennai, Pune and Mumbai micro-markets also have high vacancy rates, from the teens to the 30's! A bit worrying.

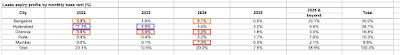

Fortunately, they don't have many lease expiries in these oversupplied areas (red, below). Most upcoming expiries are in the strong hyperabad market (blue):

They've probably planned this, so hopefully they can make it through the downturn without much DPU loss.

Work From Home

This has been in the back of my head bugging me. Technology or Business parks are just cheap offices with server and equipment rooms attached. Most workers want to work from home at least a few days a week. Most IT work can be done remotely. And most Indian IT professionals are paid enough to hire help to look after the children. Even working from home one day a week will cut office space demand at the margins, leading to rental drops for the fixed office supply. We may see this over the next few years of lease renewals.

Growth

Their pipeline looks good:

Leverage and Capital Structure

Will they have to raise capital?

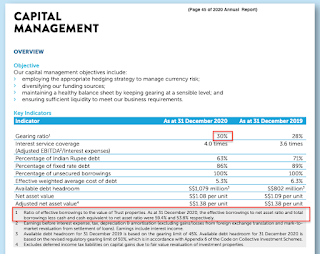

They say they only have a gearing ratio of 35%, and debt headroom of nearly SGD 1bn. I could not calculate 35%, either from their Supplementary Info or Balance Sheet. I get 40-45%. I also see different numbers in their 2020 Annual Report. So I don't know how they calculate their leverage:

Anyway, MAS' 50% leverage limit does not apply to Business Trusts, so its voluntary for AIT. Their leverage ratio can be whatever they say it is.

Everything depends on their debt headroom. In 2021, interest and dividends paid equalled CFO. But CFI outflows were more than CFO, resulting in a large debt increase.

AIT has only raised capital once after their IPO: a small SGD 150m private placement in November 2019. It was mildly pro-forma DPU accretive (p4).

Conclusion

I like AIT's long term track record of growing DPU. They have good tenants, long property tenure (or freehold), and an expansion plan in progress. I expect short term hiccups from the exchange rate and the property cycle as part of doing business.

They will probably have to raise equity soon, as interest plus dividends paid now equals CFO. Thats OK, as long as its not dilutive.

I'll keep holding it.

No comments:

Post a Comment