I think we get a market correction this year followed by a wild boom into 2023/24. Beyond my boring dividend stocks, I'm looking for speculative risk-on assets to hold in the coming melt-up. Stuff that can make me rich.

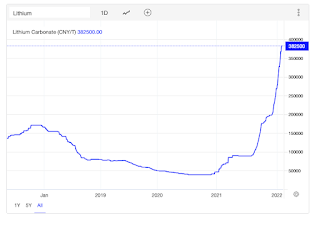

Lithium might be one.

Lithium Demand and Supply

The textbook way to estimate a commodity's price is to model future demand against supply and see how they balance out. With lithium its pointless. Typical estimates have EV sales and lithium supply doubling from 2022 to 2025, then doubling again by 2030. Both the supply and demand charts look exponential. With such high growth rates, small change makes a big difference. Any numbers you toss around are a wild guess.

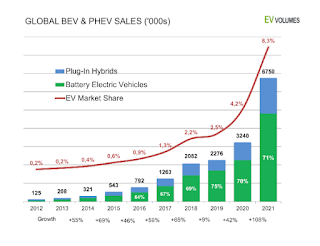

On the demand side: I think electric vehicles are becoming mainstream in developed countries. Ford's F150 lightning selling out, for example. I think they become something that normal people want to drive. EV's had an 8.3% market share in 2021, they have plenty of way to go:

Exponential chart. Source: EV-volumes.com

For supply: while you can find lithium compounds anywhere in the world, there may be a shortage of mines and processing facilities. Modelling this more than a three years out is impossible as we don't know which mines will come online and which will be cancelled. One model both indicates a slight surplus in 2022, with deficits in 2023 and 2024 (Matt Bohlsen's Jan 2022 Model - paid link).

The Lithium Industry

The traditional method of extracting lithium carbonate is from brine. Lithium rich waters are pumped into evaporation ponds in the desert, and left to evaporate for 2-3 years. The time taken depends on rainfall. During that time production cannot respond to changes in demand. This method is the lowest cost, accounts for around 35% of lithium production, and is used in South America.

The remainder is produced from hard rock. Ore is crushed, then undergoes several separation processes to produce a concentrate. This uses more energy and is more expensive, but takes less time. Its used in Australia, which acts as the swing producer.

It usually takes 5-7 years to start up a lithium mine. Sometimes up to ten years.

Future potential supply sources are:

- New extraction techniques being researched. Clay mining is being trialled.

- Recycling

The Players

- The largest producer, with an estimated 22% market share.

- Only 37% of their FY2020 revenue was from lithium.

- They were profitable in a crappy 2020.

- Debt is around 4.5X 2020's CFO.

- They regularly issue new shares.

- 3rd Largest Lithium producer, with an estimated 17% market share.

- 75% of their 2020 gross profit and 86% of 1H21 gross profits were from lithium, the remainder from batteries.

- Also profitable in 2020, excluding fair-value gains.

- Debt is around 5-6X 2020 CFO. A bit high, but not in any danger of going under.

- Aggressive expansion plans to increase their capacity to 200,000 tonnes LCE per year by 2025. Thats 4 times their 2019 production.

- They regularly issue convertible bonds or new shares.

Conclusion

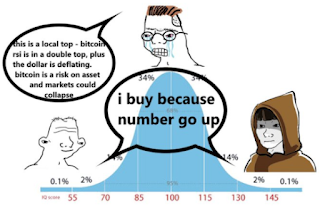

When your'e buying into a growth industry, you can't value it. I think the best you can do is:

- Wait for the right time: when its plausible that demand could outweigh supply, and when risk-on assets are going up.

- Buy something that won't go to zero. Or if it can, position size appropriately.

- Ride the trend. Number go up.

Just to be clear, I'm not buying now. Maybe in a few months.

2 comments:

Just a friendly advice: it's 1772, not 1722.

Thanks!

Post a Comment