Norsk Hydro is an integrated, low-cost Norwegian Aluminium producer, one of the few outside China.

The Aluminium Production Process

Aluminium is produced in several steps:

- Bauxite (Aluminium Ore) is mined. There is no shortage of bauxite in the world.

- Alumina (Aluminium Oxide) is refined from bauxite by a chemical process.

- Aluminium is extracted from alumina, using electrolysis to break up the aluminium/oxygen bonds. This is energy intensive. 30% of the aluminium price is accounted for by electricity.

- Extrusions. Aluminium shaped into bars for industrial use:

The Aluminium Market

China produces 40-60% of the worlds aluminium:

Source: international-aluminium.org (Interactive chart)

This is powered by cheap coal. Due to power shortages, China became a net importer in 2021. Now Europe has energy shortages and China's coal-based production is ramping up again.

So aluminium is one of the few commodities that may go *up* if China collapses or invades Taiwan.

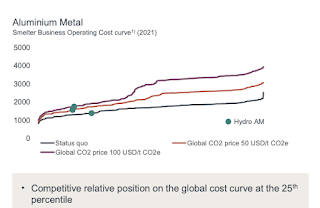

Norsk Hydro puts themselves just in the 1st quartile of the cost curve. Lower, if CO2 emissions are taken to have a cost:

Source: Company Presentation March 2022 (slide 11)

Norsk Hydro Businesses

Main Segments Segments

In 2021, about half of revenue and 80% of EBIT are from bauxite, alumina, energy and aluminium combined. I count these segments together since the outputs of one segment are the inputs to another. The main cost drivers are energy, labour and carbon. The main profit driver is the LME aluminium price.

The mining and processing of bauxite into alumina takes place mostly in Brazil. Most of the alumina is shipped to Norway, where they produce Aluminium using electricity from hydro power (their "Energy" segment).

Half of revenue and 20% of EBIT is from extrusions (aluminium metal shaped into long pieces, like steel rebar). Its a margin (cost plus) business, unaffected by raw material prices.

Upcoming Business Segments

They have a number of upcoming businesses:

- Recycling: A small business, where they source, sort, recycle and produce products (slide 21). Some capex is required for sorting and recycling plants. Recycling is a margin business, and less capital intensive than aluminium production, and with a high IRR. 2021 EBIDTA was 160m (~ 0.5% EBIDTA), aim for 700-1.1bn NOK in 2025 (at 1:06).

- HydroRein: Using wind and solar to decarbonize aluminium production. Building greenfield wind and solar parks is capital intensive and usually done in partnership with Norsk taking a minority stake. Possible IPO (slide 9).

- Batteries: Hydro is also investing in battery production for EVs (slide 10). 2.5-3b capex per year till 2025 (p12).

- Havrand: Using electricity to generate green hydrogen to eventually replace their own natural gas usage. Short on details: seems to be at the R&D stage.

- HalZero: New R&D project which successfully converts Alumina to Aluminium without releasing carbon dioxide.

I have some concerns with these. HydroRein will need a lot of capital: a 2021 presentation (

slide 8) says an equity raise is being considered. A lot of battery capacity will be needed to convert intermittent wind/solar to baseload power - I''m not sure if lithium-ion batteries are suitable. And producing these types of batteries for EVs seems a distraction. I have not heard of hydrogen being stored/piped on an industrial scale: the closest I've come across is

Air Products' hydrogen pipe network. Hydrogen is hard to transport/store as the gas molecules are too small. Hydrogen pipes have to be sealed a lot tighter than for natural gas, and hydrogen liquifies at higher pressure and lower temperatures than LNG.

Hydrogen embrittlement affects steel tanks//pipes.

In short, I'm worried they may end up spending too much on unproven technologies just to appear green. I'll come back to the capex numbers later.

The Numbers

All numbers are in NOK.

Balance Sheet

Very strong. After an exceptional 1H22, net debt is 5b, less than an average year's free cashflow.

Cashflows

Since the aluminium price is the biggest factor affecting profits, start with it:

\

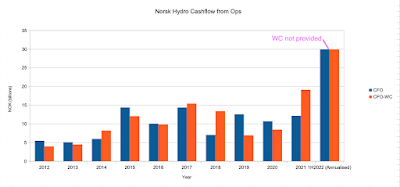

Norsk Hydro's operating cashflows:

Movements in working capital are quite large, so I remove them - they should cancel out over time anyway. After that, the orange bar follows the aluminium price, as expected. 1H22 cashflows are massive.

Average CFO over the past 10n years was 9.7b (excluding 1H22's spike) and 11.6b (including it).

Now lets add Cashflow from Investments:

After subtracting CFI, cashflows are usually positive (yellow line). The average yellow bar over the past 10 years is 7.1b (excluding 1H22's massive spike) and 9b (including it).

Is 1H12022 an aberration? The very top of the cycle? Or is it the new normal after Aluminium prices have been artificially depressed for a decade by subsidised production (in China), cheap energy and globalisation?

Capex

Total capex in 2021 was NOK 6.9b. Most of this seems to be maintainehnce capex, they did not break it down (p31).

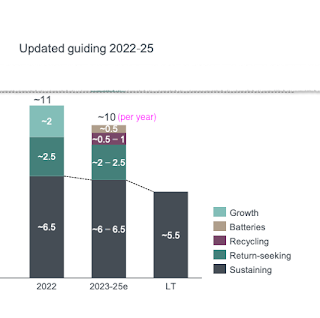

Capex is expected to be 9-11b per year (147:25) between 2022 and 2025. Of that, sustaining capex is 6 to 6.5b:

Source: Capital markets Day 2021 (slide 67)

REIN and Havrand are *not* included in the above capex guidance, and are mostly separate from the parent company. "The external equity injections based on capital raises in their respective companies allocated to the specific project's SPV will impact Hydro's consolidated capex, but not their cashflow. Non-recourse project financing at SPV level, which will cover the majority of investments in REIN and Havrand is target to not impact Hydra's balance sheet" (1:46:56).

So basically, plans now are for ~10b per year of capex in the next 4 years.

The above capex is part of the plans to reduce CO2 emissions by 30% by 2030. This looks reasonable (eg: switching to natty from oil for Brazil's Alumina production). But thery have further plans to become a "Net Zero" company after 2030:

Source: 2Q22 Investor presentation

That part looks pretty vague. Again, I am worried about the technology not being feasible. Chemical & industrial processes don't scale. You can't just run them on AWS.

Capital Structure and Dividends

The target dividend payout ratio now 50% (of profits) over the cycle, with a floor NOK 1.25 per share (NOK 2.5b in total).

2021's dividend is 6.5 NOK per share (or a total of NOK 14b). Plus a 2b share buyback, so 16b. This is way over a 100% payout ratio, so not sustainable. 1H22's results were spectacular, with almost 15b CFO, but we have several years of 10b capex in front of us and commodity prices are always uncertain. I would be a bit more comfortable if they paid for that first, before dividends. Norway's government has a 1/3rd stake in this company, and I wonder if they pushed for higher dividends.

Their net debt is 5bn, and they target 25b debt over the cycle (slide 11).

As of 2Q22, they have hedged some production going forward at prices slightly above today's price (slide 24):

Valuation

Against a market cap of 131bn (@ today's share price of NOK 64.2):

- Based on the last 10 years free cashflows (yellow bar), its 18.5 times FCF (if we exclude 1H22 earnings), or 14.5 times if we don't.

- Or 11 times 2021 (peakish?) earnings.

Commodity stocks can't be valued, since you are just predicting the commodity price.

Conclusion

I'd like to buy, but its too expensive now based on pre-2021 results.

We are in a bear market now, and I think the price of Aluminium (and Hydro shares) drop for a while. May be worthwhile later, when the cycle turns, inflation comes back and energy supplies get squeezed again. Bonus as a possible hedge against China.

After 2020, this stock will probably never be "dirt cheap", the best we can hope is to buy it at a fair value and ride the next commodity price wave.