Largest Australian LNG producer, with long-life conventional projects.

Its a well-covered blue chip, so no point over analysing it. I just want to get a feel for their risks and numbers.

GeoPolitical Risk

Very low. All 2021 production and 94% of their 2P reserves were from offshore Australia. So its is safe from any wars/revolutions in Russia, Asia or the Middle East. About half their 2C gas reserves are in Canada, and they have some development in Senegal.

Some China risk. 30-40% of Australia's LNG exports go to China. Probably the same proportion for Woodside's. If China attacked Taiwan, these would need to find a new market. That event would probably tank the LNG market.

Some ESG risk: In 2021 19% of Woodside shareholders vote to "manage down" oil and gas production. Australia is pretty woke.

Reserves

After dropping for the past 7 years, 1P and 2P reserves doubled in 2021, the increase being transferred from their 2C reserves (p56), almost all of it to due to first time reserves classification of the Scarborough development (West Australia) (p145) (p26).

Taken at face value, they have 12 years of 1P gas reserves remaining.

Balance Sheet

Net debt is low at 3.7bn. Less than 1X 2021 EBIDTA (a good year). Or 2X 2020 EBIDTA (a bad year).

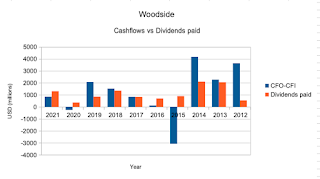

Historical Cashflows

They paid high dividends, even in 2020's downturn. I'm a bit uncomfortable with this. I did the numbers below to get a feel for their last past 10 years' cashflow generation, capex and dividends.

CashFlows from Ops are usually greater than Cash(out)flows For Investment. The yellow line is usually positive:

Dividends are high, based on 50-80% of NPAT. No relationship between cashflows generated and dividends paid out:

Over the period, the average annual cashflow generated (CFO-CFI) was 1.2bn The average dividend paid out was 1.1bn. So they paid almost all cash generated as dividends!

These dividends are a little high and could be better used for growth. But they are probably sustainable - its not a ponzi. I just dislike cyclical companies that pretend to be something they aren't.

The latest 2021 dividend of USD 1.35 is 80% of NPAT.

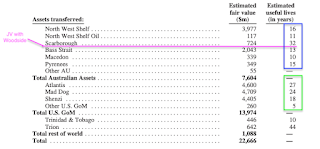

BHP Merger

- Almost doubled the number of issued shares (up 95%)

- Not increased debt, but added a 4.1 billion provisions (restoration, I think)

- Increase 1P reserves by 62% (in MMboe - however BHP's reserves are 'oiler', at around 30% oil) (p235)

- Changed production profile to be 'oilier': up to 30% oil. Also change production profile from 100% Australian to 15% GOM and 5% Trinidad and Tobago (near Venezuela) (p238)

- Increased CFO from 3792m to 6314m (up 86%).

- Increased CFI from 2941 to 4042 (up 37%)

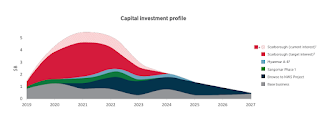

Capex and Production Growth

For Woodside, the term capex means "Cashflow from Investment".

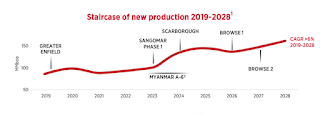

I couldn't find much. Best I found was 2019 (pre-covid) slides expecting a 2021 peak in capex of 4-5bn (slide 39):

With ramp ups in production volume till 2024-2026 (slide 9):

Actual 2021 CFI was 2.9bn. Looks like a lot of investment has been pushed back and is still to come.

Presentations and transcripts in 2020 and 2021 don't give long term capex targets, they only give them for the following year. 2022's capex is expected to balloon to 4bn (excluding BHP's assets) (p24).

No comments:

Post a Comment