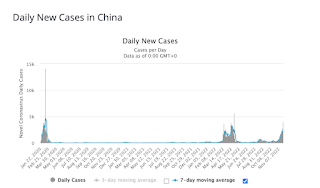

I think China is reopening. Rising cases occur when you reopen:

But official deaths have not gone up. A quick google search shows a median of 18 days to die from covid, so we should know the death rate by now. The latest numbers have 1 covid death yesterday:

Source: Worldometers.com

There's 2 risks to the reopening:

- China numbers are bullshit, so no one knows what the real hospitalisation/death rates are. Low level officials will make up whatever numbers they think are desired. And I'm sure no one reports bad news to Xi.

- Everything depends Xi. He can reinstate zero-covid tomorrow.

We're getting a lot of confusing scenes out of China. Protests, lockdowns and confusion. It will be localised cycles of easing and tightening as they try to flatten the curve. If they don't lock down soon, it will be too late, and they will have to let it spread. So there's a small chance Xi imposes a harsh lockdown soon, and a bigger chance - growing larger by the day - that they just let it spread and try to slow it down.

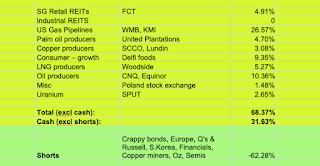

My "China reopening play" is oil. Zero-covid reduced demand by an estimated 0.5 to 1.5m bpd. Long term I think oil goes up anyway, but China makes me buy it now. Bought more CNQ and Equinor in the last 2 weeks, now its a 9% position (at buying price). 1% more to go.

Its a very oily portfolio: 10% in oil producers, plus another 35% in things correlated to oil (Gas pipelines, palm oil and LNG).

Also mechanically adding to my shorts as the S&P500 goes higher. And the existing shorts are also growing bigger as the market gets higher; my shorts are now in the red:

Need to remind myself not to get too short, else the bear market rally will rip my face off.

Can't find anything to buy with the remaining 30% cash. Despite a year-long bear market, stocks aren't cheap enough yet to catch falling knives. I wait, either for things to get cheaper, or for the macro tide to turn so I can buy cyclicals like capex commodities.

Its hard, sitting in cash, foregoing dividend income, not going long or short. I try to imagine myself as a multi-millionaire in the future, after the current bear market, recession and subsequent commodity bull.

Doing nothing is the hardest thing.

2 comments:

Don’t you think copper will correlate to oil with China demand? Brazilian copper exports likely increase imo

Hmm.... I don't see copper and oil correlating, they are completely different. Copper is used for buildings and the electrical grid. Can't see China residential property recovering. Maybe they use some copper building more infrastructure.

Once people are let out of their homes, they use more oil. Not copper.

Post a Comment