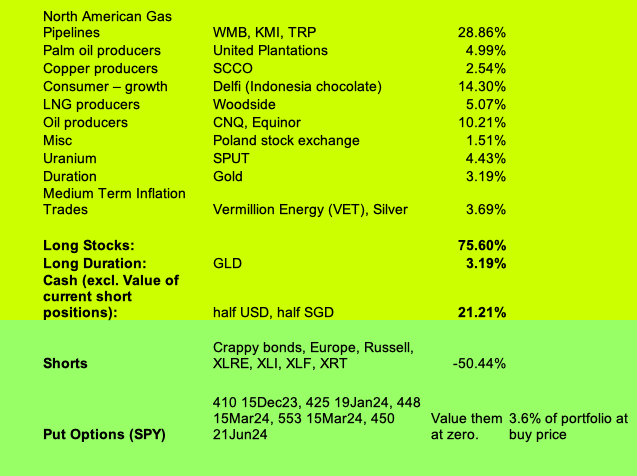

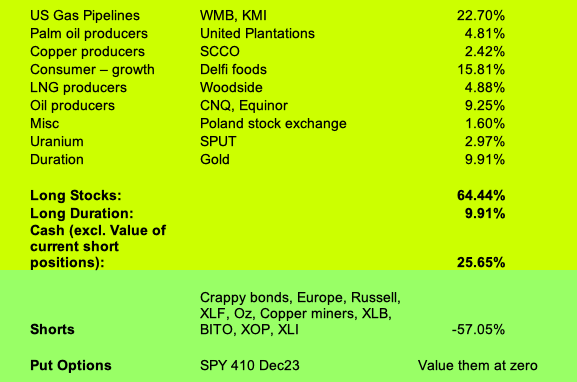

I love gas pipelines, like Buffet's toll roads. This company owns pipeline throughout North America. The stock has fallen due to crappy management, and is below its 2020 price. Its got world class assets, and I don't think bad management can destroy it no matter how hard they try. Lets take a look.

Segmental Breakdown and Pipeline Details

From their 2022 AR. "EBIDTA" below means "2022 Comparable EBIDTA".

The business is transporting gas over a continent, so we gotta look at a map to understand it:

US Gas Pipelines (41% EBIDTA):

- Columbia Gas (6): Transports gas from the Marcellus to markets and pipeline interconnects throughout the U.S. Northeast, Midwest and Atlantic regions.

- ANR (7): Transports natural gas from various supply basins to markets throughout the U.S. Midwest and U.S. Gulf Coast.

Canadian Gas Pipelines (28% EBIDTA):

- NGTL (1): gathering and processing from producers in the WSCB to the Canadian Mainline.

- MainLine (2): Transports gas produced in East Canada to West Canada.

- Costal GasLink (26): Pipeline under construction to ship gas from WCSB to the west coast for LNG export. Its construction has had bad cost overruns, but is now 91% complete. Expects to be operational 4Q23.

Mexico Gas Pipelines (8% EBIDTA).

Liquids Pipelinse (14% EBIDTA):

- Keystone (not shown above, see p62). Transports crude oil from Canada to and through the US for refining, down through Oklahoma to the GOM. Canada cannot refine most of its crude, which is exported by pipeline to the US (87% of total crude in 2020), and Keystone transports around 14% of that. There were (costly) expansion plans (Keystone XL) approved by Trump which were cancelled by Biden.

Nature of Revenue and Pricing

Nearly 80% of their EBIDTA is regulated (

p28):

- Meaning that rates negotiated with customers have to be approved by government agencies (FERC - US, CER - Canada) to prevent price gouging.

- The Canadian Mainline (7% of EBIDTA) was built before US shale gas was discovered, and has since struggled to compete with cheap US gas coming from the Appalachian Basin (Marcellus). It has no pricing power. In this case prices drop - regulation doesn't matter.

So regulation does limit upside a bit, while not protecting downside.

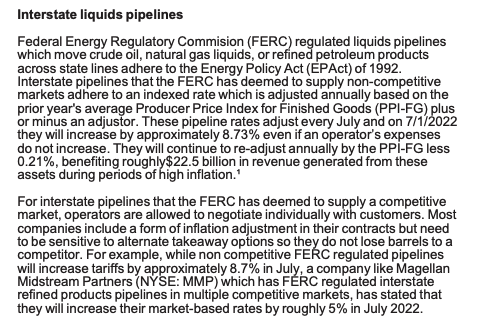

Some FERC rates are automatically-inflation adjusted. Depending on the pipeline classification, rates are automatically adjusted every year, or inflation adjustments are written into the contract with the customer:

I could not google any information on wether the Canada Energy Regulator adjusts rates for inflation. The company says NGTL "operates under the terms of the 2020-2024 Revenue Requirement Settlement which includes an

ROE of 10.1 per cent on 40 per cent deemed common equity." (

p178) To me, this does not sound like it adjusts for inflation.

Here are some hints that it does take inflation into account:

I could not get any details. Not sure if they will adjust the entire tariff by the inflation rate, or only the part reflecting increasing maintenance costs (while excluding build costs from the past). This would be a small adjustment as maintainence costs are low for gas pipelines.

So for inflation protection:

- US pipelines adjust for inflation. Yearly if its a "non-compeditive" pipeline. For "compeditive" pipelines, its based on the contract, so will depend on if you have pricing power.

- Not sure if/how Canadian pipeline tariffs adjust for inflation (?)

- If an area has too many pipelines and not enough demand, prices will go down, regulation and inflation adjustments don't matter.

Cashflows

Dividends are lower than CFO, but CFI is very high due to capex on new projects. CFI plus dividends has exceeded CFO in many years:

Projected capex is below. Maintenance capex (part of CFI) is approximately ~2bn per year. I've annotated for their

later Costal GasLink blowout:

So its not until 2026 that they'll start paying down debt.

Debt

At end 2022, debt was 51bn: 41bn in loans or notes, plus 10bn in Junior Subordinated Debt. Thats unsustainable, at 8X 2022 CFO, or 12X 2022 FCF. CFO should grow (probably another 3bn in the next 5 years) as the new projects come online, so that makes it a bit better.

Debt maturity (I have not broken it down into USD/CAD debt):

What is the effect of rising rates on their debt? I went through years of annual reports - they did not make it easy - to consolidate their debt issuance. They have:

- 30bn fixed rate debt

- 8bn floating rate

- 3bn unknown

- 10bn Junior Subordinated debt. (p195). These are fixed rate for the first ten years,before converting to floating rate.

If all debt due by end-2027 is refinanced at 9% (The 20 year risk free Canadian rate is ~3.7%, the US one is 4.5%. I'm using a high rate for high debt and shitty management)...then their 2022 results would have ben lower by 900m, a 20% reduction in FCF. The same stress test for WMB and KMI give 10% and 7% reductions respectively.

The key thing for this company is no more cost blowouts till 2025, then being able to pay down debt after that.

Risks

- Canada's carbon tax is $20/ton today, but due to increase to $170 by 2030.

- The company has a history of operational problems: Milepost 14, Keystone pipeline leaks, Columbia gas line pressure drop. Concerned it may be a cultural issue.

- To much debt, especially when the Junior Subordinated debt converts.

- They may move into ESG and renewables, which have lower returns.

Valuation

At CAD 48, its trading at a 7.75% yield. Thats paying out 75% of their 2022 FCF.

New projects coming online should increase CFO by half in 3-5 years, but they need to pay down debt.

Misc

I don't know the withholding tax rate. Interactive Brokers usually charges me 15% for Canadian stocks, but TRP has significant operations in the US, so it may be higher.

Edit: Nov 2023: Confirmed my witholding tax is 15%

The stock plunged three weeks ago on news of the Keystone spinoff, then recovered. It looks like capitulation, so that may be the turning point.

I have bought a 2.5% position, and would go up to 5%. My max size for this is half that of WMB or KMI, who have less operational and financial risk.

References