Earnings vs Cashflows

First, ignore the Net Financing. These contain large profits or losses from their currency hedges (mark to market), irrelevant to their underlying business. All the earnings below exclude this.

Lets see how past earnings and cashflows compare:

The stated earnings “smooth-out” the Cash Flow from Operations (CFO). Sometimes they are higher, sometimes lower. For the next two years, CFO is expected to be below earnings as large numbers of new Trent 1000 and XWB engines are built at a loss. When this happens, revenue and profits from future maintenance and long term contracts are recognised at the initial point of sale and held on the balance sheet as assets under Accounts Receivables. In detail:

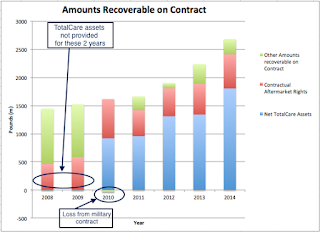

All these assets are held under "Amounts Recoverable from Contract" under Receivables. TotalCare Assets (in blue below) have risen to form the majority of these:

This is a risk, given given the uncertainty in estimating the revenue and costs of long term contracts. Rolls gave an model example for a single contract (slides/transcript):

The resulting profit (and difference from cashflows) is modelled as:

The modelled profit/cashflows over the product's lifecycle (building many engines over the decades):

In Roll's 1H2015 presentation (p24), the cashflows for their newest engine show that they expect it may be a drain on cashflow for a few more years:

I don't think there is anything funny going on, but earnings will be below cashflows for the next few years, and I need to understand this if I'm going to hold the shares. As investors, we have no way of knowing how aggressive their accounting is. Their accounting practices were reviewed by the FRC in 2014, where they agreed on the treatment of TotalCare.

The expected free cashflow for 2015 is between -150m to +150m (p17). Essentially zero. I'm guessing it may be negative for a few years after that.

There may be write offs risk if flight hours decrease suddenly (e.g.: SARS, financial crisis) or planes are grounded. If that happened, I'd regret buying the shares before the write-off, instead of after.

Cashflow Generation

A look at Cash Flow from Operations and Cash Flow from Investments. Major acquisitions/disposals and one-off events for CFI are annotated:

Both annotated acquisitions are for non-aviation businesses. Without them, they would have generated cash every year. Hopefully the new CEO will stop.

In the long run, ten years or so, if Rolls wants to develop a narrow-body engine, that would take considerable investment.